The field in question provided by Amazon Business, is a code that identifies the class of the product for the purposes of applying VAT. Thanks to this code, Amazon will be able to separate the VAT from the sale price, and in the event of subjects with multiple VAT numbers (or from 2020 with the European VAT management) also make private individuals pay the current VAT with the type of product and the residence of the buyer. The VAT Classification field is sent individually for each item, and must match one of the values in the Amazon Business list. For example, for an article such as pasta (fresh or dried) the VAT classification code corresponds to A_FOOD_PASTANOODLE. The list of valid values is made available by Amazon.

In the bindCommerce interface, you can consult the VAT codes available by following the menu

Marketplace > Amazon > Common parameters > Standard VAT codes

It is possible to indicate the VAT classification, within the offer preparation parameters going to

Menu > Marketplace > Amazon > Offer preparation parameters

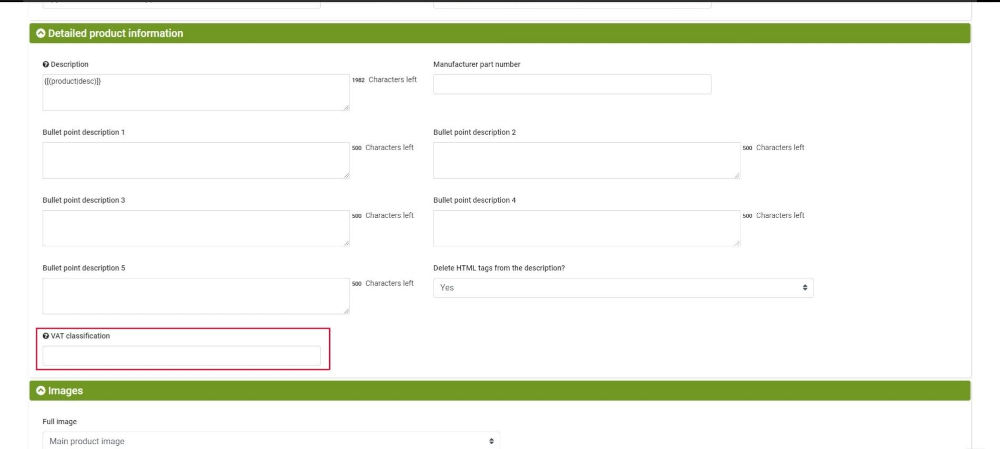

By creating or modifying a new configuration, you will be able to indicate the value relating to the VAT classification in the following field: VAT classification

It is possible to indicate a fixed value or to dynamically retrieve the value from an attribute using a placeholder (see paragraph “Placeholder” of the tutorial relating to the offers preparation parameters).

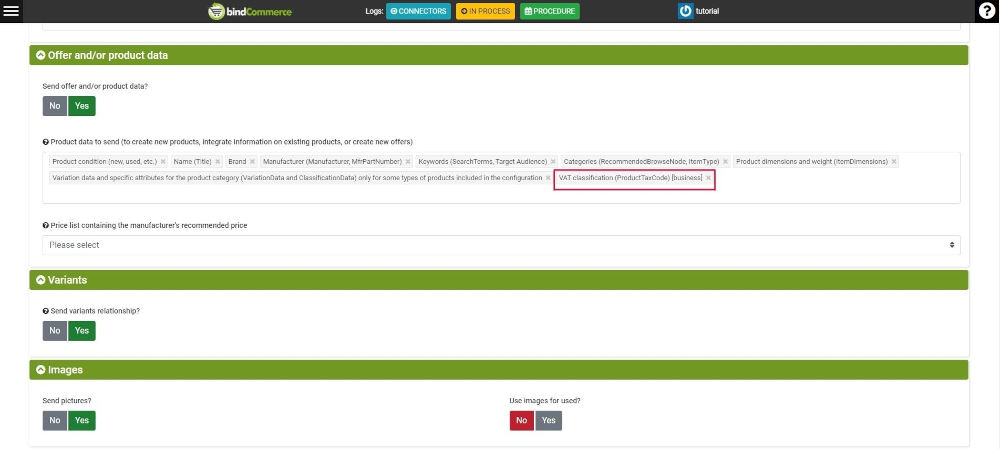

After having generated the offer internally, in order to correctly send the data to the marketplace, it is necessary to go to the configuration of actions on Amazon products/offers and indicate the sending of the field “VAT Classification (Product tax code) [business]”

Thank you for rating this article.